Thoughts on another Inflationary “Recession”

Earlier this year, we experienced a snow which extended down to the Florida coast. I’m sure many were surprised to wake up and find snow on the beaches and the palm tree fronds. It’s rare to see snow in Florida.

It’s also very rare to see negative GDP growth when we are experiencing inflation. It’s near impossible to happen unless we consider “real” GDP growth which is defined as the growth minus the current inflation rate. Prior to a few years ago, recessions were defined as two consecutive quarters of negative real GDP growth. This happened in 2022 when the Federal Reserve started raising rates more aggressively than any time since the early 1980s.

Recently the media and many talking heads have been talking about the price of eggs and other things driving inflation higher and having a recession at the same time. This is about as likely to happen again as it is for us to see snow in Florida going into the summer months. What is more likely is that one or the other will happen, not both.

We see a deflationary recession much more likely than a return of inflation over the next few months. Tariffs are likely to have less affect than the massive budget cuts, layoffs and spending reductions in government. That said, none of these are likely to filter into the economy within days or weeks. The government employees all have severances which last through September and spending is just now starting to slow down. However, a lot of people have grown fearful since the end of February without much news to possibly cause a panic. Corporate earnings are still growing, and overseas markets are still going strong.

What could be lurking underneath the surface?

The individual investor survey showed extreme bearishness starting late February with levels below anything we have seen since 2022. Consumer credit card debt and buy now pay later loans show that most consumers are currently tapped out. The yield curve moved out of its long inversion period in late 2024 and markets are overvalued by any measure you look at. But all these issues were issues before the election, with the exception of investor sentiment. It’s rare for sentiment to move this low without a spike in market volatility. So what could have caused fear to set in?

In talking with clients, it seems those who watch a lot of news and those who have been on Facebook the most seem the most fearful. Many have shared with me that they have turned their Facebook news feed off and have stopped watching the news as much because they can’t take the persistent negativity.

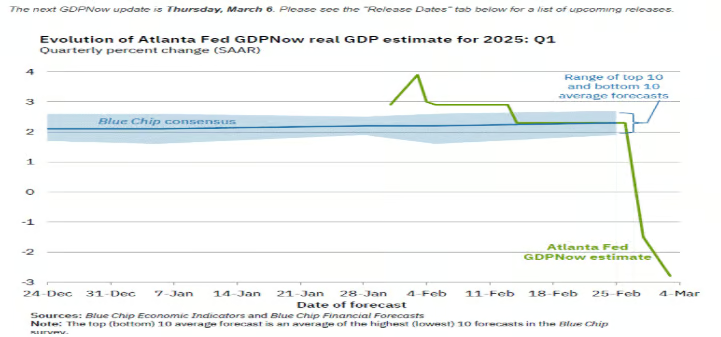

Also, the Atlanta Fed “GDP Now” estimate suddenly dropped from GDP growth expectations of over 2% to under -2% during the last week of February. Most of this is due to their expectations regarding prices of goods and foreign trade. This forecast was pretty good at predicting recessions for a few years until 2020 when they started to miss the mark by a wide margin and completely missed both the pandemic drop in GDP and the V shaped recovery. Because of the sudden shift in this estimate and how it seems to be solely attributed to tariffs, most find it hard to give this measure much credence.

Through mid-February, the stock market was drifting higher, driven by strong fourth-quarter earnings, improving economic data, and positive momentum in key sectors. The S&P 500 closed at a new all-time high on February 19. The move, however, lacked conviction as other major indices failed to follow suit, signaling a divergence in market breadth. This was the first sign of weakness in the markets.

Bearish sentiment led to a further market selloff, greater volatility and weaker breadth in the markets over the last couple of weeks. It’s rare for things to happen in this order but not unheard of. A VIX volatility “fear” gauge spikes above 30 typically coincides with bottoms.

U.S. Market Bottoms also tend to accompany low breadth readings. When less than 25% of stocks are above their 50-day moving average, we can expect positive returns going forward. As breadth gets worse from here our expected return increases for the next month to over a year in the future.

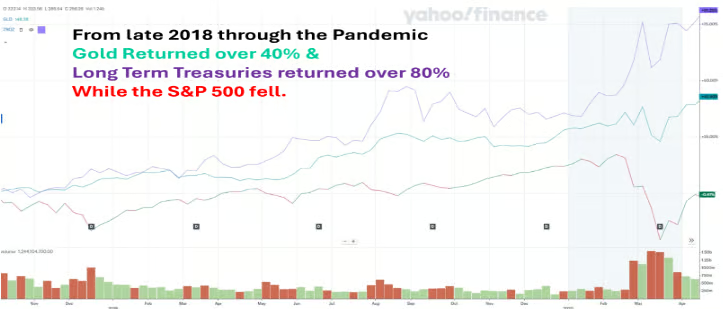

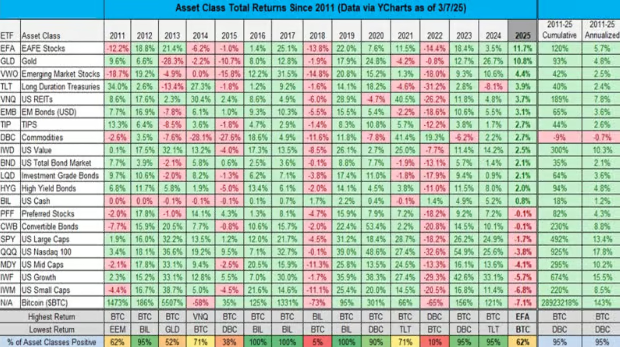

So far this year bonds and gold have performed well. Heading into recessions and bear market periods we start to see the bond market and stock market diverge. Investors start to sell out of stocks to buy bonds to go “risk off” and then sell bonds to buy stocks to go “risk on”. Eventually bonds and gold usually win out when the market reaches its final bottom.

Considering this, investors may wish to increase their bond and gold exposure on market rallies. It is also worth noting that the last time we saw this “risk off” / “risk on” behavior, the markets rallied from the 2018 lows to an eventual high in 2020 before the pandemic drop. Those investing in gold and long term treasuries from late 2018 through March of 2020 fared better than those invested in the “market”.

It seems that market leadership is shifting. The Magnificent Seven no longer seems so magnificent with Tesla down over 40% and all but Meta suffering losses year to date. The weak dollar combined with stimulus measures in foreign countries has led to outperformance of overseas investments in relation to the U.S. Dividend paying value-oriented investments have also fared better year to date, but the smaller companies have yet to start outperforming as we would expect in a less regulatory environment.

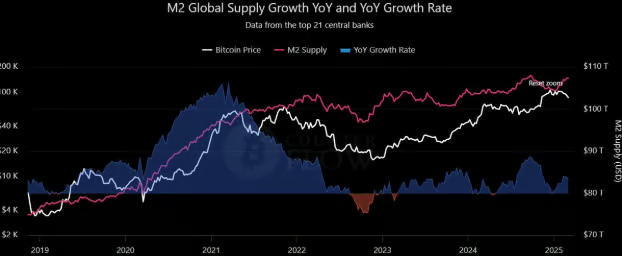

Bitcoin has suffered a downturn over the past couple of weeks after the Bybit exchange hack. However, this selloff is consistent with others during a bull market. As Bitcoin grows in popularity and makes its way into more institutional portfolios, it will start to move more with global stock markets. The Crypto Fear & Greed Index hit a multi-year low on February 27th but has started to improve since then. It has not been long since this same index was firmly in the green.

Bitcoin (white) tends to lag global money supply. A peak in money supply in September led to a peak in Bitcoin in December. Money supply is likely to hit a new peak later this month which usually leads to a new peak in Bitcoin with a 2-to-3-month lag.

Based upon the most recent halving in April of 2024, Bitcoin is currently significantly below its “stock to flow” valuation. Money supply is likely to push it higher even if the stock market has already peaked for the year. Many may believe that if Bitcoin can withstand the pandemic, it can withstand anything. However, the massive stimulus response during the pandemic with lower rates and record government spending led to a V shaped recovery. Bitcoin has never been tested during a more significant downturn in the economic cycle.

Given all we are currently seeing in the markets, we expect a nice rally from here and possibly new all time highs in the major indices. At the same time we feel the odds of recession are increasing and we will likely see market averages below where we are now by the end of the year. Long term treasuries and gold will likely be the safest places to ride out the storm. Conservative investors may want to position accordingly while aggressive investors may want to ride the next wave higher from here over the next few months.

Joe Franklin has been named by Forbes as one of Tennessee’s Top Advisors!

Franklin Wealth Management

4700 Hixson Pike

Hixson, TN 37343

423-870-2140