What do Baseball and Investing Have in Common?

Ted Williams was the last player to ever hit over .400 in Major League Baseball (.406 in 1941). Williams combined power, patience and control to achieve 521 lifetime home runs, more walks than any other batter in his day, and a lifetime .344 batting average (which puts him at #7 all time).

He had the intelligence of a lead-off hitter and the brawn of a power hitter; the patience of a bench warmer and the bat control of a single hitter. His contribution to the game was to increase the waiting time to hit a perfect pitch; he said that a good hitter can hit a pitch that is over the plate three times better than a great hitter with a questionable ball in a tough spot.

Williams knew, for example, that a high and inside strike pitted his weakness against the pitcher’s strength. If he consistently swung at those pitches, his batting average would suffer. A low and outside pitch, (which many umpires like to call the “money pitch”) produced the same results – a success rate far below Williams’ lifetime batting average.

However, if Williams received a pitch in his optimum strength zone, he put all his muscle into it, knowing that he could consistently produce a higher batting average. In constructing a template for success, Williams outlined a pattern of patience. He realized that it was often better to not swing at a pitch on the edge of the strike zone rather than swing for a low average. A called strike was better than making an out.

In his book titled, “The Science of Hitting”, he divides the strike zone into 77 squares and studied how well he hit the ball based upon which square the pitcher threw the ball to. If he waited for the pitcher to throw to one of his best squares, he hit .400. If he grew impatient and hit a sub-optimal pitch, his average dropped under .300.

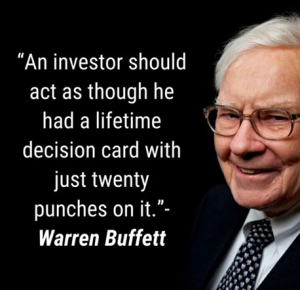

Buffet extends the same reasoning to stock picking. The stock market is like a major league pitcher who fires hundreds of pitches a day, with each pitch representing a certain stock at a certain price. As the batter, you must decide which of the hundreds of pitches to swing at, and which you will let whiz by. What distinguishes you from a baseball player, however, is that you don’t ever have to swing. The game of investing doesn’t force you to take the bat off your shoulder and swing, unlike the batter standing in the batter’s box. No umpire will “call you out.”

Buffet says, “in investments, there’s no such thing as a called strike. You can stand there at the plate and the pitcher can throw the ball right down the middle, and if it’s General Motors at $47 and you don’t know enough to decide on buying General Motors at $47, you let it go right on by and no one’s going to call a strike. The only way you can have a strike is to swing and miss.”

Warren Buffet is a great admirer of Ted Williams and, on several occasions, has shared William’s disciplined approach with Berkshire’s holders. Williams would wait for a specific pitch (in an area of the plate where he knew he had a high probability of hitting with the ball) before swinging. . It is said that this discipline enabled Williams to have one of the highest lifetime batting averages of all time.

Look at What You Are Hitting

Ted Williams said, “It dumbfounded me when a batter couldn’t tell what he had hit. Bobby Doerr was like that. Doerr was a solid .280 hitter, but he’d come to the bench and I’d say, ‘What was the pitch?’ ‘I dunno. Curve, I think,’ even when he’d hit a home run.”

It is the same in the stock market–there are different pitches that “Mr. Market” gives you. The key is to know when you are offered up a pitch that is within your sweet spot. Buffett refers to this as your circle of competence. By staying within your circle of competence and letting the bad pitches go past, you greatly increase your chances of hitting. You will be able to also hit more home runs.

If you make a large profit on any of these investments, but you don’t know which kind it is and why you did well, there is no difference between you and Bobby Doerr. You can get the ball out of the park once in a while, but you will never understand what you are hitting.

Buffett likes to share that the great thing about investing is that you are never forced to hit. You can wait and wait until Mr. Market throws you a great pitch.

This is one reason he was currently sitting on over $340 Billion in cash as of the end of 2024. He likes to patiently wait for “Mr. Market” to serve him up a better pitch and opportunities grow more abundant to allow him to start buying. It is likely he put some cash to work over the last few weeks as the stock market offered us temporarily discounted share prices. It is unlikely he has spent down even half of his cash position by this point, however.

Buffett seems to prefer financial companies and those with strong brands and high returns on equity. He looks for a big “moat” around the business, with high barriers of entry for new competitors. He looks for businesses that will eventually be able to survive bad management, because he knows that eventually all management teams make bad decisions.

When is the Best Time to Hit?

In his letters to shareholders and in the book “the Warren Buffett Way”, Buffett describes the types of pitches he prefers. He likes to stay within his circle of competence and not stray too far from this. Even more important than what type of pitch to hit is when you want to be hitting. The quality of the company is important but even more important is the price we pay. We can buy the highest quality companies at a higher price and still do well as the value of the company will increase with the continued longevity of the company, but we are unlikely to do as well when we overpay. The key is to know when we are overpaying versus times when Mr. Market is offering us a great opportunity to buy at depressed prices.

So how do we know when we are being offered a great deal?

Key Principles of Ground Floor Investing

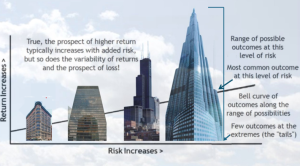

Conventional wisdom tells us that “risk” is defined by how much the investment goes up and down. Buffett disagrees with this definition of “risk”. If we know nothing about the investment except for the volatility, some might say we have a 50% chance of going up or down X amount for a “conservative” investment, or 3 times this amount for an “aggressive” investment.

The volatility is the highest just after a big drop in price. The conventional definition of the “riskiness” of the investment is defined based upon past historical downside AND upside volatility. A thinking investor will not be concerned about upside volatility because it is the upside that we want.

Furthermore, we want to consider what happens to the “riskiness” of an investment AFTER a drop in price. Buffett likes to say you want to “buy stocks like you buy your groceries, not like you buy your perfume”. He wants to get things on sale, because the earnings or cashflow as a percentage of the purchase price (the rate of return of earnings) is much higher when buying companies on sale.

The Acquirer’s Multiple

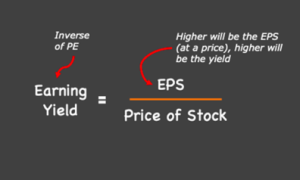

What is the most important metric for investing at good values? The book “The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market” describes how the earnings yield provides most of the information needed for making good purchases. How we determine earnings is up for debate as some want average out the earnings, especially for cyclical industries. Buffett likes to consider what he calls “Owners Earnings” which you can read about in his annual reports. In the simplest terms we may want to consider earnings before non-recurring items.

How much in earnings will we get back annually for each dollar invested?

The metric which provides this is the earnings yield. We derive this by taking the earnings of the company and dividing by the market value of the company. Most investors will take the earnings per share and divide by the price per share (this metric is the inverse of the PE ratio). A PE ratio of 10 will give you an earnings yield of 10%. This means that we can expect a 10% return per year for the company if they were to pay out all their earnings and the price per share did not change.

Returns can be even better than the earnings yield, however. If the earnings are reinvested well and the company is growing at a rate higher than the earnings yield, we can expect an even greater return. So, the earnings yield gives us the base return that we want to measure against our required rate of return.

If we are seeking a 20% return over time, we would want to wait to only buy companies with a 20% earnings yield or possibly one with a slightly lower earnings yield and a faster growth rate. The challenge with waiting for these fat pitches is that they are few and far between.

It is much easier to find companies with a strong earnings yield than it is to find one that will continue to grow at the same pace it has in recent years. Often there is a reversion to the mean and fast growth tends to slow down. Conversely, sometimes slow growth in recent years picks up with a change in management or business conditions. Often these great buys can be found in places where the business conditions seem dire, but the future is much brighter than most people realize.

Even though Buffett was freeing up cash in 2024, there were some companies like Sirius XM which caught his attention. Toward the end of 2024 he was buying shares at $21.26, when the earnings-yield exceeded 20%. In early April, the PE ratio without non-recurring items briefly dipped under 4, giving us an earnings yield of over 25%. I would be surprised if Buffett was not buying more shares.

What Floor are We On?

Many would consider taller skyscrapers to be more dangerous than shorter buildings. The Freedom Tower in New York is the tallest building in the US and may be considered the most dangerous building using this line of thinking. With 102 stories, if you knew someone was on an elevator randomly ascending and descending the tower, you might assume that he or she would be close to the 50th floor and have 50 floors of upside or downside from their current position.

If we do not know how tall the building is or which way the elevator is going from here, someone inside the elevator might note that the elevator has gone up as much as 80 floors and down as much as 40 floors. If the elevator is currently going up, they would probably feel better about the ride until it started going down and they were tempted to hit the exit button.

In investing we know a lot more about what we are buying than just the past history of price movements. Yet academics still want to consider this as a measure of risk. Buffett disagrees and shares “Price is what you pay. Value is what you get”. We know from the “Acquirer’s Multiple” if we are likely to get our required rate of return. We also know from other measurements what floor we are on.

Everything is Relative

Looking back at the 10-year chart showing Sirius XM’s historical price earnings ratio, we can see that 10 years ago, the price was over 40 times the earnings. If we are considering a long enough period, we might assume that the top floor of the building has been reached during that time frame. Likewise, we might also assume that given enough time, the elevator has been to the bottom floor at least once. In this case we know that Sirius XM reached a PE ratio of less than 4 in early April, 2025. Considering the earnings yield is over 25% at this level and the PE ratio has never been lower in the past 10 years, we can safely assume the April 2025 low was at or very close to the ground floor for this company.

When we are at the ground floor, we don’t have very far to fall. It’s the safest place to start investing. Ground floor investing in tall buildings offers much more opportunity than shorter buildings as well. There is so much more upside with 100+ stories than there is with only 5 or 10 stories. Some may say it is “more-risky” being in a taller building, but not at the ground floor. It’s highly likely the elevator will be going up a-lot from ground zero.

When are Shorter Buildings “More Risky”?

The safest time to buy treasury bonds was in late 1981 when yields were over 15%. These were the highest yields we have ever seen for 10-year treasury bonds. It may have seemed scarry to buy bonds at the time because the prices had kept dropping as the Federal Reserve raised rates. We have never seen these types of yields before or since over the last century. 1981 offered us a “ground floor” opportunity in treasury bonds. Yields continued to drop over time for the next forty years and prices increased.

During the pandemic, the Federal Reserve dropped the Federal Funds Rate to zero, and ten-year treasury bonds were paying less than ever before, with yields under 0.75%. We could say that bonds had never been more expensive given that the yield had never been lower. Bonds were paying investors less than ever before, yet investors were afraid and just wanted to be “safe”. The problem with this is that many of these investors who flocked to the “safety” of bonds got a rude awakening when the yields started to go back up and the price of the bonds started crashing.

In 2020 we reached the top-floor of what most would refer to as a shorter “less risky” building. In 2022 we learned how much more damage can be sustained investing in “safe” investments at bad prices. Early in the year the Federal Reserve started raising rates and they did not stop until they had hiked by over 5%. Bond values were decimated. Investors suffered the worst year in over 100 years for bonds.

The next time someone shares with you that bonds are less risky than stocks or that something with higher volatility is more-risky than something that goes up and down less, ask them some follow-up questions. Ask them, “What is the expected return for this investment?” or “Where are we currently compared to the best or worst historical valuation for this investment?” These questions may provide better answers for your investment portfolio.

Buffett Buying at the Ground Floor (Another Example)

Who remembers “New Coke”. There are times we can buy great brands at good prices. In the mid-1980s the “Pepsi Challenge” had many people taking a blind taste tests to compare the two colas. Diet colas and Pepsi were taking market share away from Coke. Coke released “New Coke” in 1985. Sales were lackluster and Coca-Cola stock tanked. But Buffett saw a great brand at a good price and bought with both hands in 1986. By 1989, Coca-Cola was his largest stock holding and eventually grew to be over 40% of his portfolio. He owns the company to this day.

Buffett was not afraid to buy a great company at a depressed price. He bought at the “ground floor.” As the percentage of Coca-Cola in his portfolio continued to grow, Buffett did not succumb to the institutional imperative to diversify out of his best investments. He held onto one of the best companies in the world until he found other opportunities he liked better than Coca-Cola. In 2025, the company is still his fourth largest holding.

Don’t Trade Your Best Players

History shows that many of the best performers continue to do well, long after many are tempted to sell them. Many advisors want clients to sell their best performers because they believe a holding that has come to dominate a portfolio causes it to be too “risky”. They define risk as the volatility associated with owning these high-flying stocks. What many fail to realize is that the best performers are usually the most volatile. We don’t want to throw out those that show higher upside volatility, it’s the downside volatility we want to be more concerned about. Some end up pulling the flowers in the garden and keeping the weeds. They want to keep winter coats in the closet just in case it grows cold in the summertime.

Warren Buffett defines risk as “Not knowing what you are doing” and buying companies without an adequate “Margin of Safety.” Warren Buffett has shared time and again that “You would not sell off Michael Jorden just because he has grown so important to the team.” In fact, Apple Computer had grown to over 50% of his stock portfolio in 2023 before he started trimming it back. He may feel it is overvalued at current prices compared to companies and pieces of companies he may want to buy within the next couple of years. The end of this bull market may be near, and Warren Buffett seems to be preparing for this. However, Buffett cannot invest in many smaller companies and it takes longer to free up cash when you have a $500 Billion portfolio than if you working with a fraction of this.

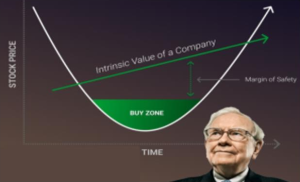

Buffett likes to calculate “intrinsic value” for a company and buy only when the price is well below this value. This discount is what he refers to as a “margin of safety”. Companies that are growing and selling well below their intrinsic value allow us to win in two ways. We win by buying at a great price and we win through the future growth of the company.

If we see a lot of future growth out of a top-quality company, it makes sense to pay a little more. Over time, Buffett has shifted from buying good companies at great prices to buying great companies at good prices. The game becomes easier when we don’t have to make as many decisions owning great companies with good growth prospects. Owning quality affords us this luxury.

The graphic below shows the top three performing stocks of all US companies over the past 20 years through the end of 2024. Those who sold too soon and sold to reduce “overconcentration risk” lost out on a good chunk of upside. We are all guilty of this. We want to remember, the best management teams and best companies tend to keep winning as the years go by. The key is to track whether earnings and revenues are accelerating or decelerating, as well as the current price compared to what we feel is the true value of the company.

How Do We Follow Buffett’s Lead?

One great way to follow in the footsteps of great investors is to read the SEC reports and buy when they buy. Sometimes we can even buy at better prices, like with Sirius XM. In 2024 Buffett was adding to his cash position as he saw fewer and fewer companies selling at prices that met his rate of return criteria (as defined by Buffett’s definition of Owner’s Earnings). Investors wishing to buy large U.S. companies would be wise to follow his lead when Buffett makes major moves.

Most are not hampered by Buffett’s portfolio size and still have the ability to buy smaller companies. Others may have circles of competence that allow them to see opportunities in other areas. Still others may be more focused on non-US investments, early stage ventures or may employ a “top down” style which contrasts with Buffett’s “bottom up” style of investing. Portfolios may differ based upon these factors.

Investors can follow Buffett or another manager and invest in the same investments after they are forced to report their holdings. Individuals can also invest directly and not worry about missing an opportunity. For most, we recommend investing directly with those managers who have proved successful and show the following characteristics:

The Best Managers tend to:

-

Eat their own cooking (invest in the same holdings as their clients)

- Be proven to protect in down markets

- Have lower turnover (less than the 100% per year average we see currently)

- Have the right temperament (not be influenced by fear, greed, or what is popular) – indexing is definitely popular now

- On a more concentrated portfolio (30 or fewer individual positions are common)

- Be disciplined (have a strategy and stick to it without deviation)

The best investors tend to be more focused when they see opportunities. They become greedy when the crowd is fearful and fearful when the crowd grows greedy. Not everyone has the temperament to go against the crowd and buy great values when they present themselves. Not everyone has the time available to act quickly when opportunities present themselves and find the diamonds in the rough. For those without the time or inclination to do this themselves, we recommend you work with a manager who displays these characteristics, give them time, and you will likely do well.

Joe Franklin has been named by Forbes as one of Tennessee’s Top Advisors!

Franklin Wealth Management

4700 Hixson Pike

Hixson, TN 37343

423-870-2140